意志还是信任

关于礼物

A charitable bequest through your will or revocable trust is an easy and flexible way to help us in our mission to build a world of longer, 更健康的生活. Your will or trust gives you peace of mind knowing your loved ones are taken care of, 你的资产分布准确, 你的礼物反映了你的个人价值观. By including a bequest to the 美国心脏协会 in your estate plan, you ensure you’re leaving a lasting impact that will sustain our work into the future.

好处

- 在你的一生中,你对你的资产拥有控制权.

- You main flexibility with the ability to modify your bequest as your circumstances change.

- You can customize how to make your gift by specifying a specific dollar amount, a particular asset (such as stock or real estate) or name the Association as a remainder/residual beneficiary of your estate by leaving a percentage of whatever remains of your estate after all specific bequests are paid.

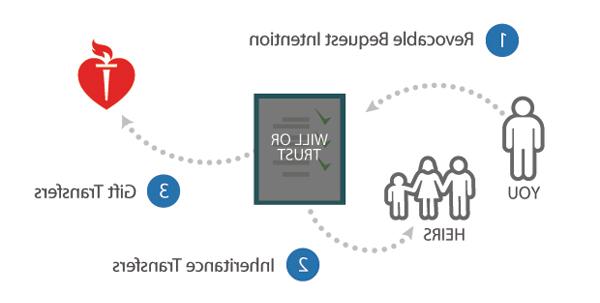

它是如何工作的

- Plan today for a future gift to the 美国心脏协会 by including a bequest in your will or revocable trust.

- Your will or trust passes assets you specify to your heirs after your lifetime.

- Your will or trust directs a bequest to the 美国心脏协会 after your lifetime to help us sustain our mission.

合资格慈善分配

关于礼物

如果你是70岁半或以上,有一个传统的个人退休账户, you are eligible to make a tax-free donation directly from your IRA to the 美国心脏协会 called a 合资格慈善分配 (QCD). 一般来说, these gifts are tax-free and can be a smarter way to support 美国心脏协会 this year.

适用于72岁及以上的老年人, 合资格慈善分配s can count towards your required minimum distribution, allowing you to use your IRA to support heart healthy lives today, 明天, 为子孙后代.

多亏了遗产IRA法案, the annual qualified charitable distribution (QCD) limit of $100,000现在是直接捐赠给慈善机构的索引. Individuals age 70½ or older are permitted to make distributions from their IRA directly to charity and avoid reporting of the income.

The 美国心脏协会 works with FreeWill, making it easy for you to donate from your IRA.

好处

- 这是一种产生影响的节税方式. Because the distribution isn’t taxable income, it’s effectively a charitable deduction.

- You can direct your gift to a specific fund or purpose within the 美国心脏协会.

- The distribution can count towards your annual required minimum distribution (RMD) for those 72 and older.

- It’s a special opportunity for individuals aged 70½ and older to give up to $100,00 annually.

它是如何工作的

- Notify your IRA custodian to make a direct transfer of the gift amount from your IRA to the 美国心脏协会. Or simply make your gift quickly and securely using our online platform.

- Obtain a written acknowledgement from the 美国心脏协会 (different from a tax deduction receipt) to benefit from the tax-free treatment.

股票,债券,共同基金

关于礼物

当你赠送股票和其他证券时, you make an outsized impact without taking money directly out of your bank account. +, neither you nor the 美国心脏协会 will be taxed on the gains for appreciated assets you donate.

好处

- 你可以立即收到所得税的节省.

- 你也许可以避免因增值股票而缴纳资本利得税.

- 当你把股票直接捐给慈善机构时, your gift can be up to 20% larger because you avoid the taxes you’d incur from selling and donating the cash.

- Stock gifts are easy to transfer using our platform powered by FreeWill.

- Donations of appreciated securities may be designated for a specific fund or purpose in the association’s mission.

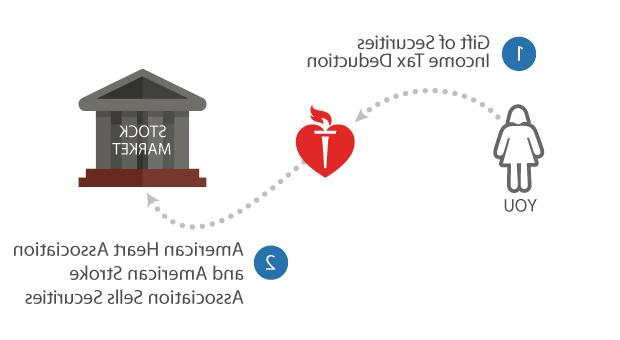

它是如何工作的

- 选择要捐赠的证券.

- 提交转让证券的请求.

- Your stock is transferred to the 美国心脏协会 and sold to fund our lifesaving work.

准备捐款? 请致电888-2227-5242与您的代表或 要求更多关于制作股票礼物的信息.

人寿保险

关于礼物

When the original purpose for a life insurance policy no longer applies, you can donate your policy to the 美国心脏协会 to help fight heart disease and stroke.

好处

- 当你转让人寿保险单的所有权时, you can receive an immediate income tax deduction for the cash value of the policy. Donating life insurance allows you to make a significant lifesaving gift today without affecting your cash flow during your lifetime.

它是如何工作的

- You transfer ownership of a fully paid-up life insurance policy to the 美国心脏协会.

- 协会可立即兑现保单, 或者选择保留保单,以后再领取福利.